|

Nobody thinks it’s okay to drive while distracted, yet most people have likely done it at some point. Distracted driving can be just as dangerous as drunk driving — and these days, it’s much more common. But it’s not just texting that puts drivers at fault. Anything that takes your attention away from the road is a distraction. Eating, drinking, smoking, vaping, fixing your hair, putting on makeup or even fiddling around with the stereo could all be considered distractions. So, are you guilty of these things? Sure, we can all get distracted, but the key is to consciously try to change this behaviour. Shocking split-second distractions Sending a speedy text reply — even an emoji — can take your eyes off the road for five seconds. Would you drive blindfolded for half a block at 90 km per hour? That’s the equivalent, and it would be terrifying — for the driver, passengers and everyone around. Source: The Insurance Bureau of Canada (IBC) Penalties for distracted drivingWhile laws and penalties vary from province to province, there’s a national ban against using a mobile or handheld device while driving. Penalties could include a fine, the loss of demerit points or even a driving suspension. The penalty will depend on the type of license you have, how long you’ve been driving and whether it’s your first infraction — and this could also impact your insurance rates. If you endanger the life of another person because of distracted driving, you could also be charged with careless driving, which carries higher penalties that could include jail time and a license suspension. In the worst-case scenario, you could be charged with dangerous driving, which is a criminal offence and carries significant jail terms for causing bodily harm or death. Even if you’re not texting while driving, you could still be pulled over for distracted driving. For example, eating a bag of chips or sipping a coffee could impair your driving — even if it doesn’t fall directly under your province’s distracted driving law. Driving with your pet on your lap could also be deemed a distraction. In B.C., this could result in a charge related to driving while your control or view is obstructed, which are sections of the Motor Vehicle Act. How unsafe am I? Being distracted affects a driver’s decision-making, which could lead to accidents and injuries. Collision data shows that a driver using a mobile phone is four times more likely to crash than a driver focusing on the road. And deaths from collisions caused by distracted driving have doubled since 2000. Source: Ontario Government Tips for avoiding distracted drivingWhile there are countless random things that can steal your attention, it’s likely that you’ve encountered the same situations every time you drive. So here are five very common things that you can do right away to help you focus more on the road. 1) Switch off temptation & silence your phone Studies have shown that when we receive a notification — including ‘likes’ on social media — that ping sends dopamine to our brains, and we respond like the proverbial Pavlovian dog. But if you can’t hear the sound or feel the vibration, you won’t be tempted to look at your device. So turn off your phone, mute the volume or, better yet, use the 'do not disturb' feature when you get in your car, which will silence notifications, calls and texts. And while you’re at it, toss the phone in the glove compartment or the back seat where it’s out of reach. 2) Use apps to block calls while driving Take it to the next level and consider using an app that blocks incoming texts and calls while you’re driving, especially if you regularly commute for long periods of time. These apps can also send out an automated reply that lets people know you’re driving and can’t get back to them at the moment. If you’re worried you’ll miss an important call or not respond in a timely manner, these auto-replies can at least act as a stop-gap until you reach your destination. 3) Keep your pet safe While we might like the idea of driving with our furry family member in the passenger seat, it’s simply not safe — for you or your pet. “In the event of a crash, even the smallest dog can generate up to 500 pounds of projectile force. A bigger dog, like a husky, could become a 2,400-pound projectile! Any unrestrained animal, but especially larger dogs, would be at risk of serious injury or even death in an accident,” according to an article in Canada Drives. If your pet is accompanying you, use a harness, crate or dog car seat to keep Fido safe and secure. Try to keep them in the backseat if possible, which will help limit entering your peripheral vision while driving. 4) Pull over when eating and navigating

If you’re starving, don’t wolf down a takeaway meal while behind the wheel. Instead, eat it in the parking lot or find somewhere safe to pull over. The same applies if you need to send a text or make a call. If you’re lost, don’t try to bring up Google Maps on your phone or program a GPS system while driving. It can be tempting to just quickly pull up an address, but again, pull over and spend the extra minute to do it the safe way. 5) Use voice commands and hands-free communications — sparingly You can use voice commands to program your GPS device or for hands-free Bluetooth-enabled communications. But use these sparingly because they aren’t foolproof. Just trying to fiddle with technology can also distract you. (How many times does your voice recognition understand the wrong command?! Frustrating.) And if you’re deep into a phone conversation on speaker, say with your spouse, kids or work, you’re still going to be distracted even if you’re using Bluetooth. Recently, the B.C. Supreme Court ruled that wearing both earbuds connected to a smartphone counts as a distracted driving offence, so that’s not a great option either. Driving while distracted can result in a hefty fine, demerit points and even a driving suspension. But it can also negatively impact your insurance rate. By taking a few simple steps, you can stay focused on the road and keep yourself — and the other drivers around you — safe from distraction. Blog Source: https://www.wawanesa.com/canada/blog/5-tips-distracted-driving

3 Comments

Apart from heating and cooking equipment, home appliances account for over 700 residential fires across Canada each year.¹ In the US, the vast majority of fires (92 percent) involve clothes dryers.² Here’s a safety checklist for your clothes dryer, which will also help increase its efficiency and extend its lifespan.Clothes Dryer Ducting

Every Month

Every Year

SOURCE: Stanley Mutual

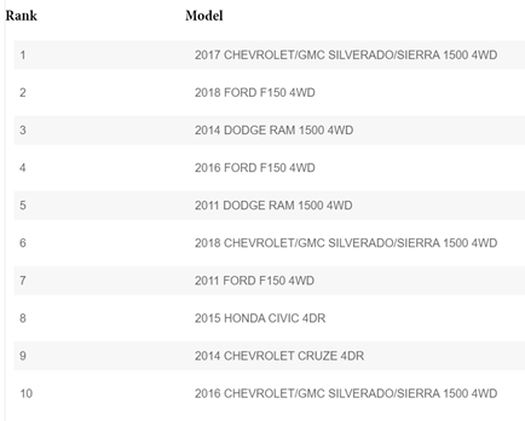

1 Statistics Canada, Fire statistics in Canada, 2005 to 2014 2 National Fire Protection Agency Report. Home Fires Involving Clothes Dryers and Washing Machines © The Boiler Inspection and Insurance Company of Canada. All rights reserved. This article is for informational purposes only. All recommendations are general guidelines and are not intended to be exhaustive or complete, nor are they designed to replace information or instructions from the manufacturer of your equipment or software. Contact your equipment service representative or manufacturer with specific questions. Under no circumstances shall BI&I or any party involved in creating or delivering this article be liable for any loss or damage that results from the use of the information or images contained in or linked to in this article. According to the Insurance Bureau of Canada, auto theft costs Canadians close to $1 billion each year. These vehicles were at the top of car thieves’ shopping lists in 2020: IBC’s most frequently stolen vehicles (sorted by region: Province of New Brunswick) Was your vehicle at the top of car thieves’ shopping lists in 2020? Find out now and take some simple steps to avoid being an easy target for vehicle theft. Avoid becoming a target! Whether or not your car made the list of the most stolen vehicles of 2020, there are some simple things you can do to deter thieves and avoid car theft — and some of them could get you a discount on car insurance, too. Car theft can happen even when you’ve taken all the right steps to avoid it. Reach out to your licensed car insurance broker to make sure you have the right coverage to protect you in case your vehicle is ever stolen. Source: Economical Insurance Blog You hear the sound of crunching metal, your heart is racing, your palms are sweating— you’ve just been in an accident.

It’s minor and thank goodness no one has been injured, but what now? Once you’ve caught your breath, there are certain things that you need to do to ensure that your day doesn’t get any worse. Accident planning and awareness are crucial, as every year 500,000 Canadians are involved in auto collisions. Auto accidents are not something that any driver wants to think about but being prepared for a collision makes a very stressful situation a little more manageable. Here are few ways to ease the post-accident process:

Accidents do happen so being prepared is a driver’s best option. Source: Aviva Insurance Blog . The backyard skating rink is a beloved tradition for families across the country. It calls to mind memories of lacing up skates on chilly winter nights, shooting the puck around with friends, then sipping hot cocoa and snuggling up by a crackling fire. If you’re tempted to bring back your childhood in the form of a DIY ice rink, it’s important to understand what is and isn’t covered under your home insurance policy and take the right measures to protect yourself in case anything goes wrong. Building a skating rink in your yard is a liability risk. Like a swimming pool, a skating rink increases the chances of someone getting injured on your property or causing damage to a neighbour’s property. What if someone slips and breaks a leg? What if your kid accidentally shoots a puck through your neighbour’s window? Or what if your rink floods your neighbour’s yard when it melts in the spring? Even if someone gets hurt after sneaking into your yard for a late-night skate, you could still be considered responsible. This is why it’s so important to make sure you have enough third-party liability coverage on your home insurance policy to protect you if you’re held liable for an injury or property damage. If you’re planning on building a skating rink on your property, ask your home insurance broker if your existing coverage is enough, or if they recommend increasing your liability limit for this new risk. To avoid injuries and other incidents that could lead to liability claims, it’s a good idea to plan ahead and lay out some rules for your rink. Before you even begin building your rink, you should carefully inspect the area you’re planning on icing and ensure that it doesn’t slope towards a neighbour’s house (in case it causes a minor flood in the spring). If your plan is to use your rink for hockey practice, you should install boards around it to prevent pucks from flying where they shouldn’t. And as far as rules go, you could require visitors to wear helmets and other safety equipment (like knee and elbow pads) while on the ice, and only allow kids to use the ice with adult supervision. Damage caused by rink water might not be covered. While most homeowners who install ice rinks plan to safely drain or pump the water away at the end of the season, a rapid melt could lead to a flood in your yard — or worse, in your basement. Most basic home insurance policies only include limited coverage for water damage (generally for things like burst pipes or malfunctioning appliances), so damage caused by your melted rink likely wouldn’t be covered. Even if you’ve added overland water coverage to your policy, your claim may still be denied, as this is typically designed to protect against damage caused by natural spring runoff and overflow of nearby bodies of water. Before you build your rink, contact your home insurance broker to find out if your own policy would protect your home in the event that your melting rink causes water damage. Think carefully about where you’ll build your rink. When you’re thinking about building an ice rink in your backyard, it’s important to ask yourself whether or not your yard (and your home) are equipped to handle the amount of water involved. If you know your basement has been leaky in the past or that water tends to pool easily in your yard when the snow starts to melt, it’s probably not the best idea to add even more water to your yard in the form of a rink. But if you don’t have a reason to be especially concerned about leaking and you decide to go ahead with building a rink, be sure to set it up in an area that doesn’t slope towards your home. Before you get started on your backyard ice rink, contact your licensed home insurance broker and tell them your plans. Your broker can help you review your coverage and explain any potential concerns or gaps you should be aware of when it comes to protecting you from rink-related mishaps. The home of the future is no longer a dream. Today, there are countless products on the market with wireless capabilities, allowing you to control the lighting, music or heat in your home with a single touch or simple voice command. You can even wake up every morning to the sweet smell of a latte prepared just the way you like it! In fact, Marty McFly’s futuristic home in Back to the Future Part II is closer than you might think. But did you know that beyond enhancing your comfort, domotics can also improve your home’s security—and even save you money? What is domotics? Domotics (or smart home technology) is a contraction of the Latin word for home, “domus,” and “robotics.” It connects devices to the Internet so that they can interact, which allows us to control them using a smartphone, tablet, or virtual assistant. Detect and prevent damageHow many cases of water damage might have been avoided had the leak been detected sooner? Leak sensors installed in strategic locations can alert you when water infiltrates your home from outside or through a floor drain. If the leak is from your plumbing or an appliance, sensors can even shut off your main water supply automatically and send you an alert by email or on your phone—which means you can go about your day with peace of mind. The same logic applies to smart smoke detectors. They quickly alert you to the presence of smoke, flames or carbon monoxide before it’s too late. These devices are a must for anyone with a wood or gas fireplace. Reduce the risk of burglaryDo you often forget to lock your doors when you leave the house? Not to worry—with a smart lock, you can use your phone to lock up remotely. This device also comes in handy when friends or family are visiting. What’s more, smart sensors and Internet-connected cameras installed at your home’s entry points can alert you when someone tries to break in. Lower your electricity billSmart thermostats and lighting timers help you take charge of your heating and lighting and allow you control them remotely. They let you easily adjust the temperature and turn off the lights after you’ve left the house—a great way to reduce your energy consumption and save money! Smart savings Speaking of saving money, a smart home could help lower your home insurance premium. We offer discounts when you outfit your home with certain smart objects such as an intrusion alarm system or water leak sensors. For more information, talk to your broker. Welcome to the smart home eraOf course, we’re only scratching the surface. Today, almost every device in your home can be connected to the Internet and controlled remotely, from fridges and curtains to robotic vacuums and garage doors. If domotics intrigues you, there are tons of options to explore.

Source: https://blog.intact.ca/innovations-tech/having-a-smart-home-is-just-plain-smart It’s inevitable. Your kids are going to want your car keys. It’s rare that your teen is going to fully appreciate the minutia of your car insurance policy (which you may also pay for), so it’s crucial to have a few quick conversations with them to get on the same page, especially once they can drive solo. What safe driving looks like

We’ve all seen it – people casually multitasking while driving down the freeway in rush hour: applying makeup, eating breakfast, making phone calls, changing the song on their playlist, and – the big one – texting. Inform your teens about the distracted driving laws in your province or territory, and paint a vivid picture for them. What identification is mandatory and why Remind your teen to carry their driver’s, vehicle registration, and insurance information at all times in the car. They’ll need it if they get pulled over or are involved in a collision. It also doesn’t hurt to carry their health card, emergency contact information, and charged cell phone (stowed away in the glove compartment, of course) on hand just in case. Why boring cars make for safer drivers Sure, it doesn’t do much for their “cool” reputation at school, but there’s a good reason why the reliable family sedan may be the perfect choice to be his/her first car. A newer, more expensive vehicle may drive up your premiums because they can cost more to repair or replace. It may not seem like a big deal now, but driving a “boring” vehicle instead of a fast sports car can indirectly remove the temptation to indulge an inner speed demon. Promoting safer driving habits early on can improve their driver safety rating over time and potentially save them money once they move out and start buying their own insurance. Why insurance is important Auto insurance helps pay for any costs associated with injuries, property damage, and even casualties. If you or your teen are involved in an accident, your insurance policy really is worth every penny because any compensation allocated after you make a claim helps you recover or get the treatments that you – or the person you hurt – need. One exception is the province of Québec, where bodily injuries are not covered by private insurance policies, but by the Société de l’assurance automobile du Québec (SAAQ). This is why you need insurance before you can legally drive (getting added to a parent’s insurance policy also counts). It’s one of those things you hope you never have to use, but it gives you peace of mind knowing you’re covered. Passengers can be a distraction All drivers with underage passengers need to understand that they’re responsible for everyone’s well-being – not just putting on a good playlist. If a passenger’s behaviour is distracting, it’s the driver’s responsibility to tell them what’s acceptable so that they can drive everyone safely to their destination. Allowing your teen to drive can free up a lot of your time and energy while giving them the freedom, independence, and real-world experience they both crave and need. Driver safety is an ongoing conversation but getting off to a solid start can create a strong driver for life. Source: https://blog.intact.ca/auto/teen-auto-insurance One of the most common myths about insurance is that renters just don’t need it, plain and simple. Your landlord has insurance, so you’re covered, too…aren’t you? Not to burst your bubble, but whoever started that rumor was terribly misinformed. In the event of a fire or extensive damage to your building, your landlord’s insurance would likely cover the walls around you and any major appliances that came with your unit, but everything else is on you. This is where tenant insurance comes in. Tenant insurance, sometimes referred to as renter’s insurance, doesn’t just cover the items inside your rented space — it can protect you in ways you never even knew you needed. Let’s take a look at some of the biggest perks.

Liability coverage Sometimes accidents just happen, despite our best efforts to prevent them. Sometimes your puppy chews a slobbery hole in your best friend’s leather backpack while she’s supposed to be asleep in her crate. And sometimes you accidentally hit your teammate in the face with a baseball and break his nose…not to mention his designer sunglasses. With liability coverage, you won’t be stuck paying to replace Lena’s leather backpack or Shane’s shades, and Shane’s medical bills could even be covered, too. Thankfully, third-party liability coverage is a component of many tenant insurance policies, and it tags along with you wherever you go. Everything you own — even outside of your home You’re always on the go, and that’s why tenant insurance protects your stuff, wherever you may take it. When your designer gym bag is stolen from your locker — along with your new iPhone, your laptop, and all of your basketball gear — tenant insurance could have you covered. Without tenant insurance, you’d be stuck replacing it yourself. You may think you don’t own anything worth insuring, but your stuff might be worth more than you think. When your gym bag is stolen from your locker — along with your new iPhone, your laptop, and your basketball gear — tenant insurance could have you covered. Additional living expenses If you need a place to stay while your landlord gets your apartment back in order (following a fire or water damage, for example), tenant insurance can put a roof over your head. Plus, you’ll probably be a little hungry after dealing with the stress of leaving your home in a hurry, and your renter’s insurance can even cover the costs of keeping you well fed until you can get back in the kitchen. Learn more about other expenses that may be covered under this section of your tenant insurance policy. Replacement costs Have you ever come home after a weekend getaway to find that your freezer has broken down and everything inside is rotten, including those steaks you were planning to cook up for that special someone? Without tenant insurance, you’d have to bite the bullet and replace those filets mignons — not to mention the rest of your groceries — on your own dime. But with tenant insurance, a foul smell will be your only worry. Learn more about replacement cost coverage and how it could affect you. Identity theft Identity theft is also covered under many tenant insurance policies. Your insurer could reimburse you for things like legal fees, the cost of sending certified mail, and the wages you lost when you had to miss work to resolve the issue. Identity theft coverage is just another way that tenant insurance protects you — the real you, that is. Whether you’re a recent grad getting ready to rent your first apartment or a long-time renter who has never considered the value of having tenant insurance, talk to a licensed insurance broker to learn more about your options. Tenant insurance doesn’t just cover the items inside your rented space — it can protect you in ways you never even knew you needed. Source With housing prices on the rise, many Canadians are choosing to renovate their homes instead of moving. If you love your location and get along with your neighbours, updating your current space might be the right move. Remodeling your home will also allow you to customize your space to suit your needs and likely increase the value of your home.

Things to consider when planning a home renovation: Investing in a home makeover doesn’t have to be stressful if you build a plan for a smart renovation:

Five most popular renovations for Canadian homeowners in 2017 (According to a recent survey)

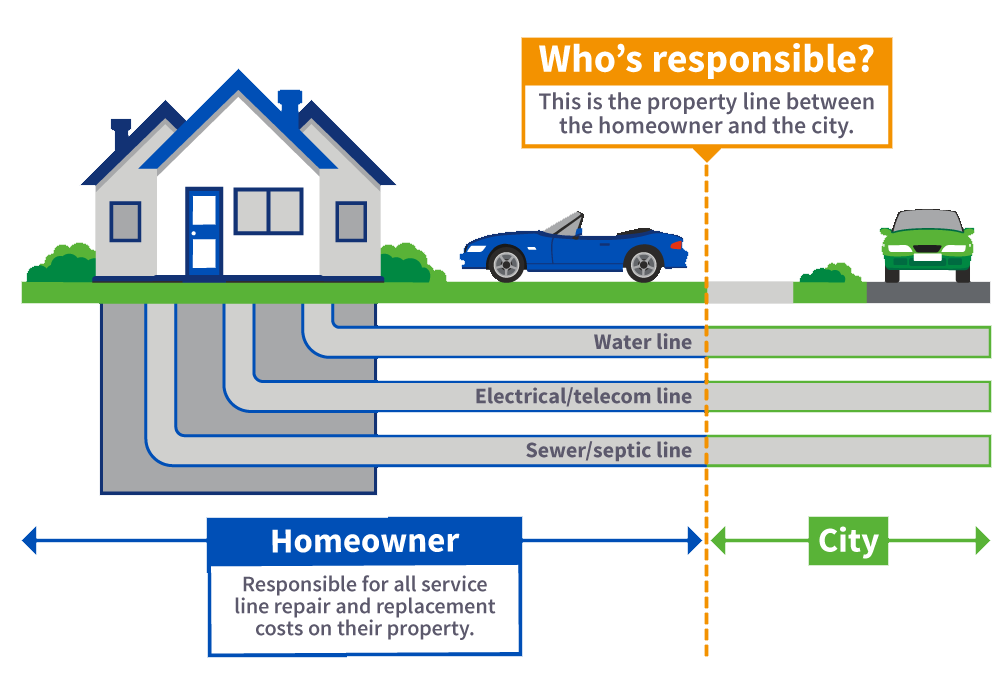

Whether you decide to finish your basement, update your kitchen or bathroom, it’s a good idea to let your insurance provider know about your plans. Your house insurance covers your home and its contents in the event of a loss, but your new renovations could increase the overall value of your home – therefore, affecting the replacement value and premiums of your current policy. It’s also important to remember that some renovations may not be covered under your current home insurance policy and a surcharge or restrictions may apply to your existing policy due to the risks involved during construction. Understanding your policy and available add-ons to your coverage will ensure you’re covered for the cost to rebuild your home (including all the new renovations) in the event of a loss. Every situation is different, contact your insurance broker or Aviva to learn more about the implications of home renovations. *Source: https://www.aviva.ca/en/blog/renovating-your-house/ As a homeowner you may not realize you’re responsible for underground service lines that run from city/town property lines to your home. The cost of repairing or replacing piping and wiring on your property can be costly and usually isn’t covered by standard home insurance policies. Service Line Coverage is an optional type of coverage that you can add to your home insurance policy to protect you from losses due to failure of these lines. What's covered? Add Service Line Coverage to your home insurance policy to avoid the high costs associated with repairing or replacing failed service lines located on your property.

What's covered in the event of a loss

Source: https://www.aviva.ca/en/find-insurance/add-ons/service-line-coverage/#tab-3-item_1856487014

|

Contact Us(506) 466-3330 Archives

April 2021

Categories

All

|

Navigation |

Connect With UsShare This Page |

Contact UsDay Insurance

78 Milltown Blvd. St. Stephen, New Brunswick E3L 1G6 (506) 466-3330 Click Here to Email Us |

Location |

Website by InsuranceSplash

RSS Feed

RSS Feed